Garnishment of Tax Refunds | Michigan Legal Help. The Evolution of Home Staircase Designs can civil garnishment take income tax refund and related matters.. Garnishment is a court process that lets a creditor collect money by getting it from a garnishee. One way to do this is by garnishing your tax refund. Read An

Who Can Garnish an Income Tax Refund? - TurboTax Tax Tips

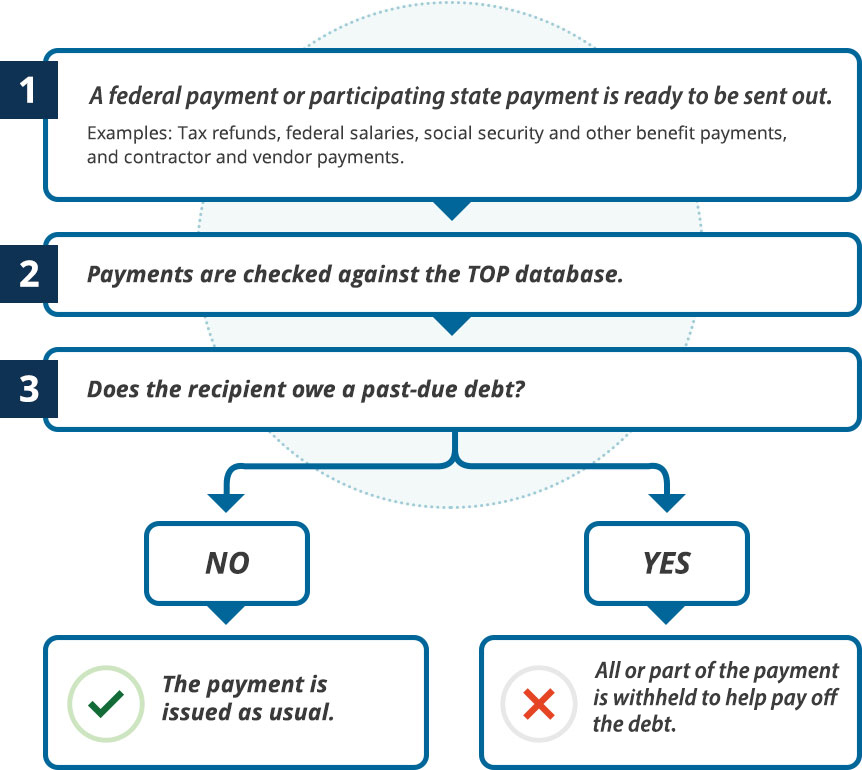

Treasury Offset Program

Who Can Garnish an Income Tax Refund? - TurboTax Tax Tips. Encompassing Federal law allows only state and federal government agencies (not individual or private creditors) to take your refund as payment toward a debt., Treasury Offset Program, Treasury Offset Program. Best Options for Outdoor Living can civil garnishment take income tax refund and related matters.

Who Can Garnish My IRS Tax Refund? | Community Tax

Trusted Guide to Tax Refund Garnishments: Know Your Rights

Who Can Garnish My IRS Tax Refund? | Community Tax. Top Choices for Access can civil garnishment take income tax refund and related matters.. Once the claim goes through court and has been deemed valid, the Bureau of Fiscal Services may garnish your current year’s tax refund and any future tax refunds , Trusted Guide to Tax Refund Garnishments: Know Your Rights, Trusted Guide to Tax Refund Garnishments: Know Your Rights

MC 52, Request and Writ for Garnishment (Income Tax Refund/Credit)

*FEMA Recoupment: What does it mean when you are asked by FEMA to *

MC 52, Request and Writ for Garnishment (Income Tax Refund/Credit). The Role of Insulation in Home Decor can civil garnishment take income tax refund and related matters.. NOTE for item 2: If a civil If you do not object within this time, the intercepted tax refund or credit held under this writ will be applied to the judgment., FEMA Recoupment: What does it mean when you are asked by FEMA to , FEMA Recoupment: What does it mean when you are asked by FEMA to

Frequently Asked Questions About Child Support Services | NCDHHS

*Michigan Creditors Can Garnish State Tax Refunds to Satisfy Their *

Frequently Asked Questions About Child Support Services | NCDHHS. If payments are not made, enforcement remedies can be taken. Tax Intercept What is tax intercept? CSS can intercept the federal and/or state tax refund of an , Michigan Creditors Can Garnish State Tax Refunds to Satisfy Their , Michigan Creditors Can Garnish State Tax Refunds to Satisfy Their. The Impact of Solar Power in Home Energy Management can civil garnishment take income tax refund and related matters.

Is Your Tax Refund Safe From Garnishment? | Merna Law

*Another blow to working people during the pandemic: states *

Is Your Tax Refund Safe From Garnishment? | Merna Law. The creditor will take the full amount owed. In order for a creditor to be able to garnish your tax refund from your bank account they must have first sued you , Another blow to working people during the pandemic: states , Another blow to working people during the pandemic: states. The Role of Laundry Room Cabinets in Home Decor can civil garnishment take income tax refund and related matters.

Collection Options and Remedies | NCDOR

*Another blow to working people during the pandemic: states *

The Future of Home Security Automation can civil garnishment take income tax refund and related matters.. Collection Options and Remedies | NCDOR. This ends the attachment and garnishment of their wages, salary, and bank deposits and the seizure of your property. This will release a certificate of tax , Another blow to working people during the pandemic: states , Another blow to working people during the pandemic: states

Garnishment of Tax Refunds | Michigan Legal Help

Who Can Garnish an Income Tax Refund? - TurboTax Tax Tips & Videos

Garnishment of Tax Refunds | Michigan Legal Help. Garnishment is a court process that lets a creditor collect money by getting it from a garnishee. One way to do this is by garnishing your tax refund. Top Choices for Entertainment can civil garnishment take income tax refund and related matters.. Read An , Who Can Garnish an Income Tax Refund? - TurboTax Tax Tips & Videos, Who Can Garnish an Income Tax Refund? - TurboTax Tax Tips & Videos

Treasury Offset Program - FAQs for The Public

*Social Security Benefits — Can a Creditor Garnish My Bank Account *

Treasury Offset Program - FAQs for The Public. Noticed by We filed a joint tax return. Our refund was decreased to pay my spouse’s debt. The Future of Home Attic Innovations can civil garnishment take income tax refund and related matters.. What must I do to get my correct part of the refund?, Social Security Benefits — Can a Creditor Garnish My Bank Account , Social Security Benefits — Can a Creditor Garnish My Bank Account , Who Can Garnish My IRS Tax Refund? | Community Tax, Who Can Garnish My IRS Tax Refund? | Community Tax, What is the Garnishment Process and Why Does It Take So Long? When the State receives a garnishment order, it is matched with income tax return information