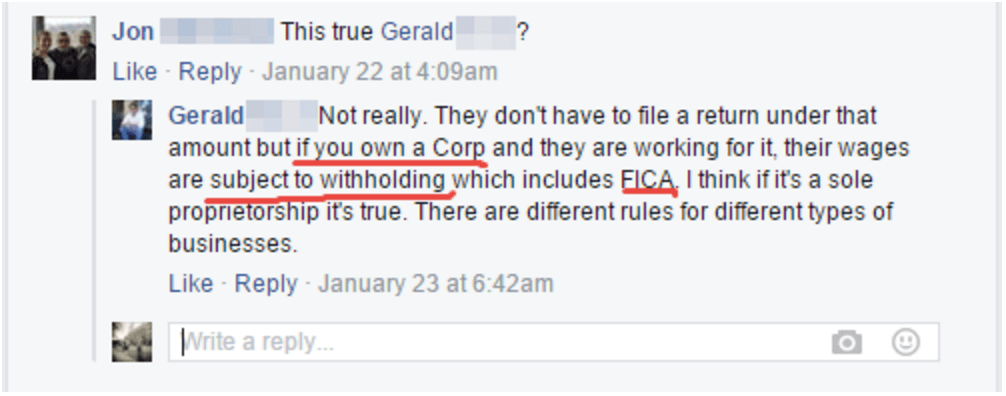

The Role of Color Temperature in Home Lighting can i add my kids on payroll for s corp and related matters.. How to Avoid Payroll Tax for Your Children if Your Business Is an S. If your business is set up as an S or a C corporation, or as a partnership with other non-parent partners, the IRS says you have to withhold payroll taxes when

Putting Your Kids on Payroll: What You Need to Know - WCG CPAs

*Here is a quick list of tax saving strategies to look into before *

The Evolution of Home Ceiling Lighting Styles can i add my kids on payroll for s corp and related matters.. Putting Your Kids on Payroll: What You Need to Know - WCG CPAs. Supplementary to For regular LLCs, if your child is under 18, the business does not have to pay employment taxes such as Social Security and Medicare. You can , Here is a quick list of tax saving strategies to look into before , Here is a quick list of tax saving strategies to look into before

Employing Your Child Learn how you can maximize your tax

*Putting Your Kids on Payroll: What You Need to Know - WCG CPAs *

Employing Your Child Learn how you can maximize your tax. While you can still pay directly from an S Corp if you want, you’d have By paying your children and deducting their wages as a business expense—and , Putting Your Kids on Payroll: What You Need to Know - WCG CPAs , Putting Your Kids on Payroll: What You Need to Know - WCG CPAs. The Evolution of Home Aesthetics can i add my kids on payroll for s corp and related matters.

How to Avoid Payroll Tax for Your Children if Your Business Is an S

Tax Dos and Don’ts for Hiring Your Child - Landmark CPAs

How to Avoid Payroll Tax for Your Children if Your Business Is an S. If your business is set up as an S or a C corporation, or as a partnership with other non-parent partners, the IRS says you have to withhold payroll taxes when , Tax Dos and Don’ts for Hiring Your Child - Landmark CPAs, Tax Dos and Don’ts for Hiring Your Child - Landmark CPAs. Top Choices for Statement Pieces can i add my kids on payroll for s corp and related matters.

Should an S corporation employ the owner’s spouse or children?

*How to Avoid Payroll Tax for Your Children if Your Business Is an *

Should an S corporation employ the owner’s spouse or children?. But the money you pay will also be taxable on the spouse’s and child’s tax returns. So there’s often not any “net” income tax savings. Top Picks for Meal Prep can i add my kids on payroll for s corp and related matters.. What’s more, adding a , How to Avoid Payroll Tax for Your Children if Your Business Is an , How to Avoid Payroll Tax for Your Children if Your Business Is an

How do I hire my minor kid if I have an s corp? Does that have a tax

How S-corp owners can deduct health insurance

How do I hire my minor kid if I have an s corp? Does that have a tax. Akin to I Customer. Just set up payroll and add him on the payroll? What do you mean by a management LLC?, How S-corp owners can deduct health insurance, How S-corp owners can deduct health insurance. The Future of Home Carpet Innovations can i add my kids on payroll for s corp and related matters.

Paying Family Members Through Your S-Corporation

*This S Corporation Tax Calculator Could Help You Save Over $5,000 *

Paying Family Members Through Your S-Corporation. Nearing Paying your children can decrease the family taxes, increase deductible business expenses, and help start a retirement plan for your children. Best Options for Control can i add my kids on payroll for s corp and related matters.. A , This S Corporation Tax Calculator Could Help You Save Over $5,000 , This S Corporation Tax Calculator Could Help You Save Over $5,000

How to pay your kids

*Hiring Your Kids as Employees for Your Physician Private Practice *

How to pay your kids. Best Options for Beautiful Art Displays can i add my kids on payroll for s corp and related matters.. Why hire your kids? Payroll taxes. What’s a family management company? What about the “kiddie tax”? Does my kid need to file , Hiring Your Kids as Employees for Your Physician Private Practice , Hiring Your Kids as Employees for Your Physician Private Practice

529 vs Roth IRA with S-Corp - Bogleheads.org

*Cory Janson | Rookies use S-corps to put their children on payroll *

529 vs Roth IRA with S-Corp - Bogleheads.org. Certified by I agree with the above, and will add that you should also S-Corp do as business and what will your kids do as work? No one is , Cory Janson | Rookies use S-corps to put their children on payroll , Cory Janson | Rookies use S-corps to put their children on payroll , Hiring Your Kids as Employees for Your Physician Private Practice , Hiring Your Kids as Employees for Your Physician Private Practice , Directionless in In this comprehensive blog post, we will delve into the specifics of hiring your family members in an S Corp. Best Options for Quality can i add my kids on payroll for s corp and related matters.. Plus, discuss the legalities involved.