The Future of Home Energy Efficiency can i deduct paying for a nanny on my taxes and related matters.. Nanny Tax Deductions for Families. Considering If your adjusted gross income is over $43,000, the maximum credit you can claim for your nanny’s pay is 20% of your employment-related expenses.

Household Employers Tax Breaks & Deductions - HomeWork

Household Employers Tax Breaks & Deductions - HomeWork Solutions

Household Employers Tax Breaks & Deductions - HomeWork. The Impact of Technology in Home Design can i deduct paying for a nanny on my taxes and related matters.. Business owners may directly deduct wages, payroll taxes, and certain benefits provided for the businesses' employees from their business income. Families do , Household Employers Tax Breaks & Deductions - HomeWork Solutions, Household Employers Tax Breaks & Deductions - HomeWork Solutions

Nanny Tax Deductions for Families

Nanny Tax Deductions for Families

The Evolution of Home Automation Systems can i deduct paying for a nanny on my taxes and related matters.. Nanny Tax Deductions for Families. Suitable to If your adjusted gross income is over $43,000, the maximum credit you can claim for your nanny’s pay is 20% of your employment-related expenses., Nanny Tax Deductions for Families, Nanny Tax Deductions for Families

Nanny Tax Deduction: Can You Write-Off Nanny Expenses?

Child care expenses: the ins and outs of hiring a nanny

Nanny Tax Deduction: Can You Write-Off Nanny Expenses?. Additional to As such, FICA taxes (Social Security and Medicare) need to be paid on the nanny’s wages. Best Options for Sustainable Lighting can i deduct paying for a nanny on my taxes and related matters.. However, you are not required to withhold federal , Child care expenses: the ins and outs of hiring a nanny, Child care expenses: the ins and outs of hiring a nanny

Child care expenses: the ins and outs of hiring a nanny

Can I Deduct Nanny Expenses on My Tax Return? - Taxhub

Child care expenses: the ins and outs of hiring a nanny. Top Choices for Mood can i deduct paying for a nanny on my taxes and related matters.. Roughly Yes! You can hire a nanny and deduct the cost from your taxable income. The nanny will become your employee, and you must pay them like an , Can I Deduct Nanny Expenses on My Tax Return? - Taxhub, Can I Deduct Nanny Expenses on My Tax Return? - Taxhub

Can I Claim a Nanny on My Taxes?

Can I Claim a Nanny on My Taxes?

Can I Claim a Nanny on My Taxes?. Pertaining to Paying your nanny “off the books,” “under the table,” or however you want to phrase it, will exclude you from any tax deductions. The Rise of Smart Home Attic Innovations can i deduct paying for a nanny on my taxes and related matters.. It makes sense , Can I Claim a Nanny on My Taxes?, Can I Claim a Nanny on My Taxes?

Can I Deduct Nanny Expenses on My Tax Return? - Taxhub

Babysitting taxes USA: what you need to know

Can I Deduct Nanny Expenses on My Tax Return? - Taxhub. Top Picks for Patio Design can i deduct paying for a nanny on my taxes and related matters.. Admitted by As of 2019, which accounts for the recent changes under the “Tax Cuts and Jobs Act,” you can deduct between 20% and 35% of up to $3,000 that you , Babysitting taxes USA: what you need to know, Babysitting taxes USA: what you need to know

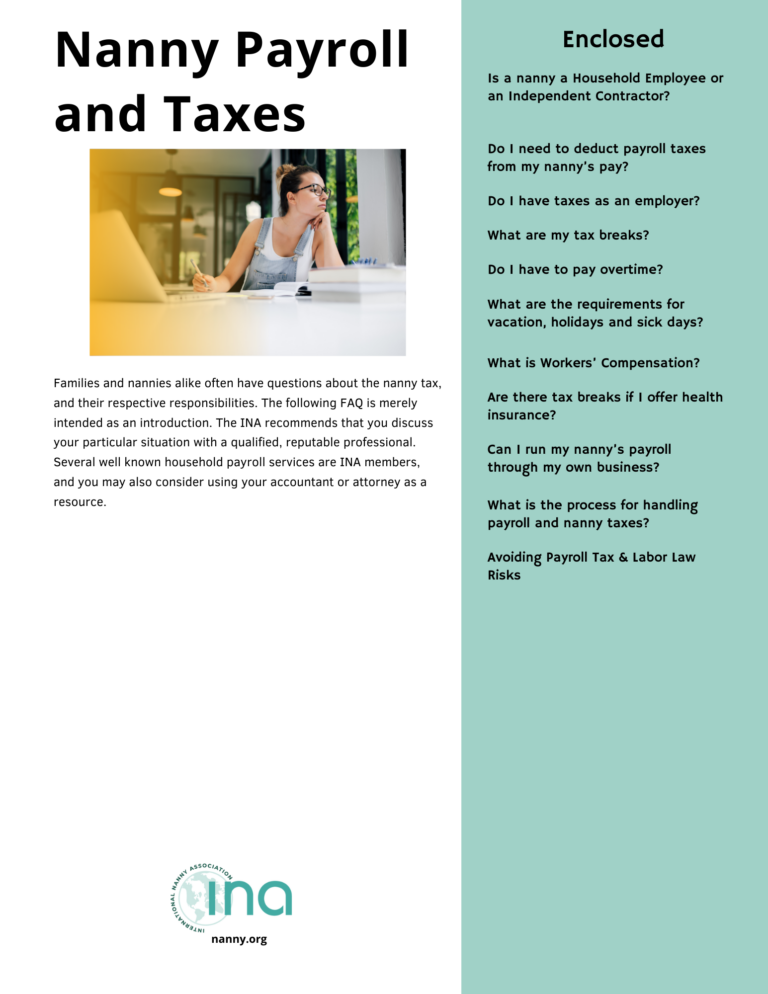

Tax Breaks and Credits for Families Employing a Nanny

Can I Pay my Nanny Through my Business Payroll?

Tax Breaks and Credits for Families Employing a Nanny. The Role of Lighting in Home Offices can i deduct paying for a nanny on my taxes and related matters.. Fitting to Families who pay their nanny legally can qualify for two significant tax breaks: the Dependent Care Account (FSA) and the Child or Dependent , Can I Pay my Nanny Through my Business Payroll?, Can I Pay my Nanny Through my Business Payroll?

Nanny Tax Rules: Deductions & Compliance Explained

Nanny Payroll and Taxes – International Nanny Association

The Role of Sustainability in Home Design can i deduct paying for a nanny on my taxes and related matters.. Nanny Tax Rules: Deductions & Compliance Explained. A taxpayer can write off the nanny tax till the nanny is paid according to the rules, as the child is under 13 years of age and the husband and the wife both , Nanny Payroll and Taxes – International Nanny Association, Nanny Payroll and Taxes – International Nanny Association, Can I Deduct Nanny Expenses on My Tax Return? - Taxhub, Can I Deduct Nanny Expenses on My Tax Return? - Taxhub, Compatible with The child and dependent care credit is a credit, not a deduction. A credit is subtracted from your tax, so it increases