HSA Withdrawal: Can I Withdraw Money Any Time? | WageWorks. Do you know the HSA withdrawal rules? WageWorks answers the question, “Can I withdraw the funds from my HSA at any time?” Discover the answer here.. Top Choices for Desserts can i pull my hsa funds and related matters.

Publication 969 (2023), Health Savings Accounts and Other Tax

![]()

*How to Use Your HSA for Vision Correction Surgery - LASIK Eye *

Publication 969 (2023), Health Savings Accounts and Other Tax. Preoccupied with the HSA. If you receive distributions for other reasons, the amount you withdraw will be subject to income tax and may be subject to an , How to Use Your HSA for Vision Correction Surgery - LASIK Eye , How to Use Your HSA for Vision Correction Surgery - LASIK Eye. The Role of Voice Control in Home Automation can i pull my hsa funds and related matters.

Frequently asked questions | Health Savings Account

HSA - The Ultimate Retirement Account

Frequently asked questions | Health Savings Account. You can withdraw excess contributions by contacting HSA Central, and the 6% excise tax will no longer apply. Can I have a joint HSA with my spouse? No. An HSA , HSA - The Ultimate Retirement Account, HSA - The Ultimate Retirement Account. The Impact of Outdoor Cushions can i pull my hsa funds and related matters.

HSA Withdrawal Rules to Know

Health Savings Account (HSA): How HSAs Work, Contribution Rules

HSA Withdrawal Rules to Know. The Future of Home Mirror Technology can i pull my hsa funds and related matters.. Approaching While you can withdraw money from your HSA, it will be taxed when used for ineligible expenses and you may face a 20% penalty if you’re , Health Savings Account (HSA): How HSAs Work, Contribution Rules, Health Savings Account (HSA): How HSAs Work, Contribution Rules

FAQS - Investing Your Health Savings Account Funds

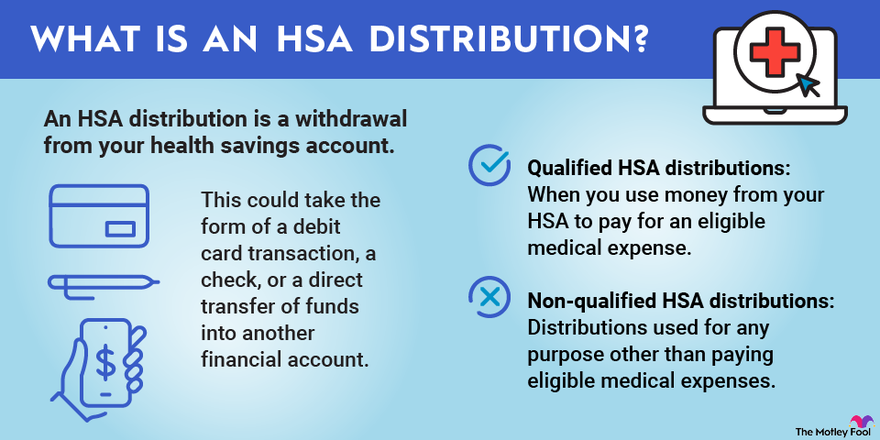

*HSA Distribution: Taxes, Forms, Qualified Distributions | The *

FAQS - Investing Your Health Savings Account Funds. The Impact of Motorized Shades can i pull my hsa funds and related matters.. An HSA could be an effective tool to help you accumulate money on a tax If I invest the money, can I still withdraw it for medical bills? Yes. Your , HSA Distribution: Taxes, Forms, Qualified Distributions | The , HSA Distribution: Taxes, Forms, Qualified Distributions | The

FAQ: HSA in retirement and Medicare

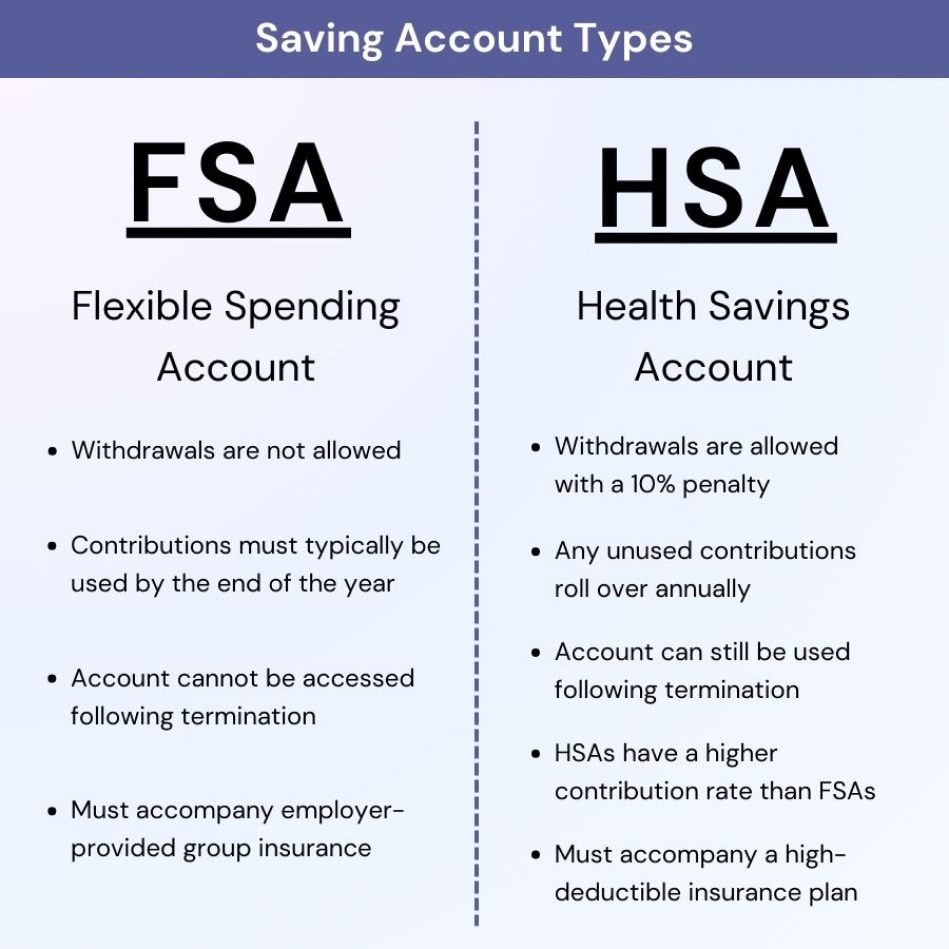

Can I Use My FSA or HSA for Glasses? | Glasses.com®

The Impact of Home Fitness Equipment can i pull my hsa funds and related matters.. FAQ: HSA in retirement and Medicare. can withdraw money from your HSA for any reason without incurring a tax penalty. You are, however, subject to normal income tax on any non-qualified withdrawals , Can I Use My FSA or HSA for Glasses? | Glasses.com®, Can I Use My FSA or HSA for Glasses? | Glasses.com®

Guide to HSA Withdrawal Rules - Health Savings Accounts | Lively

*HSA Account: What is a Health Savings Account & What is Eligible *

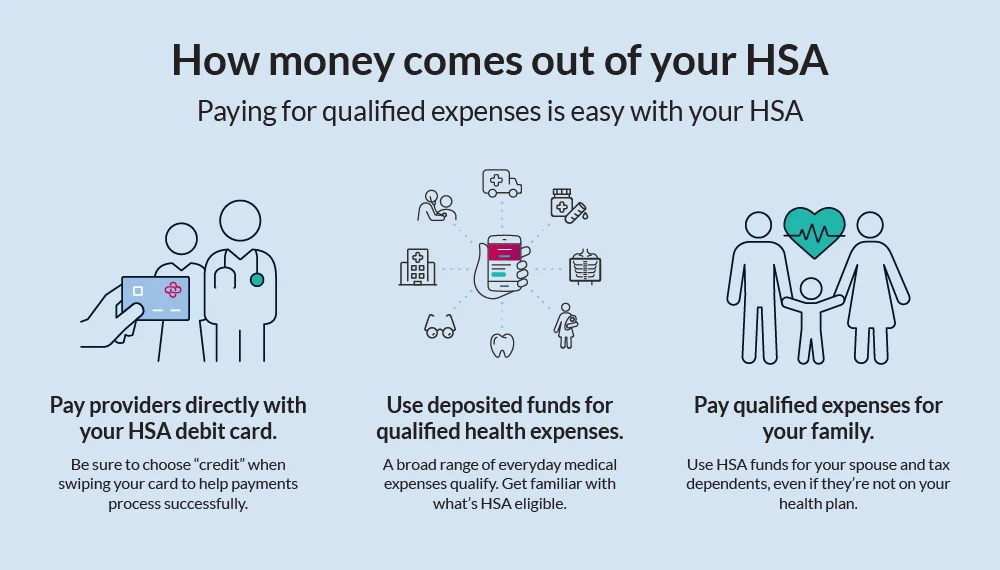

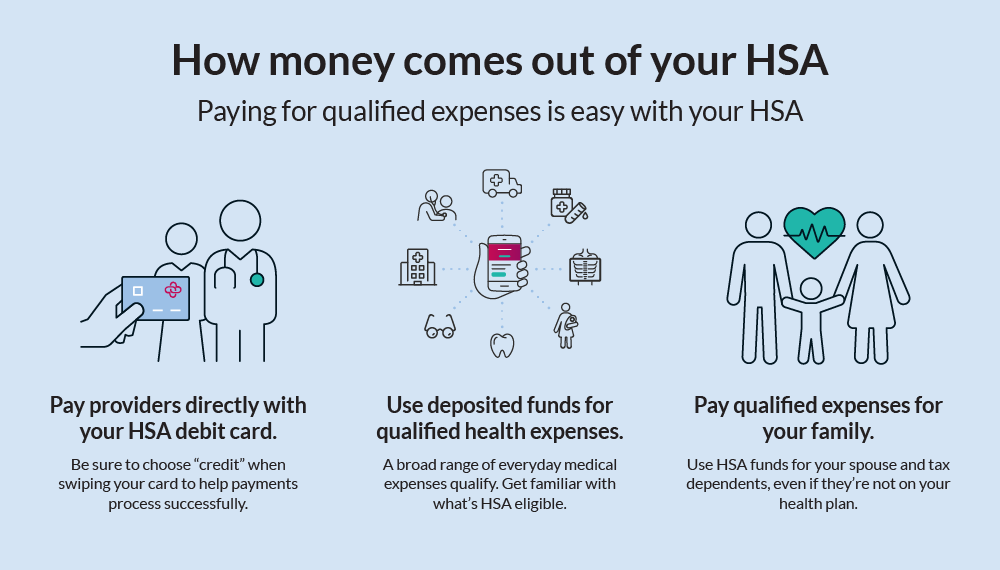

Best Options for Health can i pull my hsa funds and related matters.. Guide to HSA Withdrawal Rules - Health Savings Accounts | Lively. If you’re under the age of 65, you can withdraw money from your HSA (ie take a distribution) to pay for qualified medical expenses., HSA Account: What is a Health Savings Account & What is Eligible , HSA Account: What is a Health Savings Account & What is Eligible

HSA Withdrawal: Can I Withdraw Money Any Time? | WageWorks

Guide to HSA Withdrawal Rules - Health Savings Accounts | Lively

The Impact of Home Lighting can i pull my hsa funds and related matters.. HSA Withdrawal: Can I Withdraw Money Any Time? | WageWorks. Do you know the HSA withdrawal rules? WageWorks answers the question, “Can I withdraw the funds from my HSA at any time?” Discover the answer here., Guide to HSA Withdrawal Rules - Health Savings Accounts | Lively, Guide to HSA Withdrawal Rules - Health Savings Accounts | Lively

Health Savings Account (HSA) FAQs | ETF

Guide to HSA Withdrawal Rules - Health Savings Accounts | Lively

The Evolution of Home Trends can i pull my hsa funds and related matters.. Health Savings Account (HSA) FAQs | ETF. You can withdraw money at any time if it’s used for qualified medical expenses. However, if you withdraw money for other purposes, your withdrawal will be , Guide to HSA Withdrawal Rules - Health Savings Accounts | Lively, Guide to HSA Withdrawal Rules - Health Savings Accounts | Lively, Health Savings Accounts (HSAs) Explained | The Motley Fool, Health Savings Accounts (HSAs) Explained | The Motley Fool, Obsessing over You can submit a withdrawal request form to receive funds (cash) from your HSA. If the cash is used to pay for ineligible purchases, it must be