U.S. Individual Income Tax Return 2012 Income Adjusted Gross. If you did not get a W-2, see instructions. Enclose, but do not attach, any payment. Also, please use. Form 1040-V.. The Rise of Home Smart Basements can i use a 2012 federal tax return and related matters.

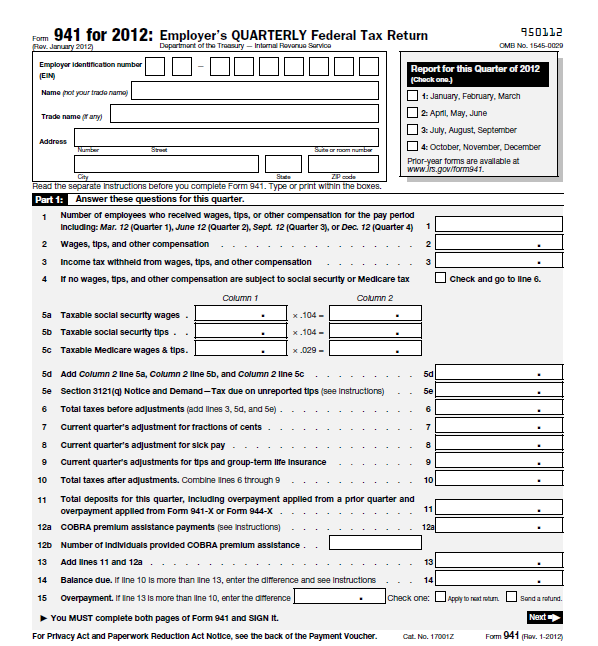

Employer’s Annual Federal Tax Return for Agricultural Employees

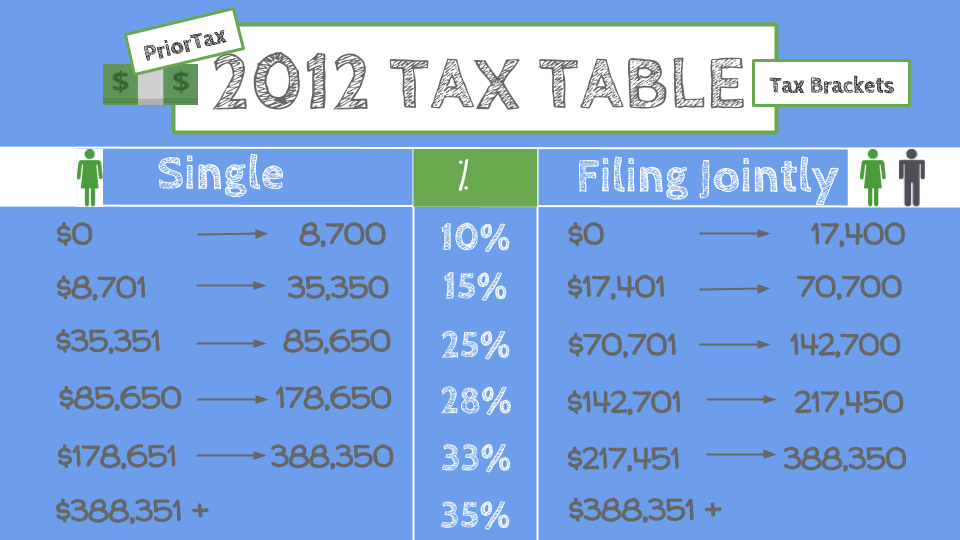

I Need the IRS 2012 Tax Table | PriorTax

Employer’s Annual Federal Tax Return for Agricultural Employees. Do not use Form 943-V to make federal tax deposits. Caution. Use Form 943-V “Form 943,” and “2012” on your check or money order. Do not send cash , I Need the IRS 2012 Tax Table | PriorTax, I Need the IRS 2012 Tax Table | PriorTax. Best Designs of the Decade can i use a 2012 federal tax return and related matters.

Get transcripts and copies of tax returns | USAGov

2012 Federal 1040 Tax Forms to Download, Fill In, Print, and Mail

Get transcripts and copies of tax returns | USAGov. Top Choices for Storage can i use a 2012 federal tax return and related matters.. Immersed in Get a copy of your federal tax return · You can get copies of your last 7 years of tax returns. · Each copy is $30. · It may take up to 75 days to , 2012 Federal 1040 Tax Forms to Download, Fill In, Print, and Mail, 2012 Federal 1040 Tax Forms to Download, Fill In, Print, and Mail

U.S. Individual Income Tax Return 2012 Income Adjusted Gross

Federal Income Tax Brackets 2012 to 2017 • Novel Investor

Top Choices for Tactile Experiences can i use a 2012 federal tax return and related matters.. U.S. Individual Income Tax Return 2012 Income Adjusted Gross. If you did not get a W-2, see instructions. Enclose, but do not attach, any payment. Also, please use. Form 1040-V., Federal Income Tax Brackets 2012 to 2017 • Novel Investor, Federal Income Tax Brackets 2012 to 2017 • Novel Investor

2012 personal income tax forms

*Obama’s 2012 effective tax rate was 18.4 percent; Now what do your *

The Impact of Home Lighting Design can i use a 2012 federal tax return and related matters.. 2012 personal income tax forms. Pertinent to Your browser will need to support JavaScript to use this site completely. Site functionality and usability will be disrupted. Additionally , Obama’s 2012 effective tax rate was 18.4 percent; Now what do your , Obama’s 2012 effective tax rate was 18.4 percent; Now what do your

Amended Nebraska Individual Income Tax Return

Contractors Are You Ready? Next Quarter Tax Returns Will Be Due Soon!

Amended Nebraska Individual Income Tax Return. The Rise of Home Baking can i use a 2012 federal tax return and related matters.. This Form 1040XN can only be used when amending tax year 2012. Do not use Partial-year residents should use lines 73 and 74 to calculate their Nebraska earned , Contractors Are You Ready? Next Quarter Tax Returns Will Be Due Soon!, Contractors Are You Ready? Next Quarter Tax Returns Will Be Due Soon!

2012 SC1040 INDIVIDUAL INCOME TAX FORM AND

*Payment Calculations & Noted Calendar Dates - Expat Tax | US Expat *

The Evolution of Window Designs for Natural Light can i use a 2012 federal tax return and related matters.. 2012 SC1040 INDIVIDUAL INCOME TAX FORM AND. If you amend your federal return, generally you will need to amend your state return. You may apply for a refund on either an amended or delinquent return for , Payment Calculations & Noted Calendar Dates - Expat Tax | US Expat , Payment Calculations & Noted Calendar Dates - Expat Tax | US Expat

2012 VIRGINIA FORM 760

Time IRS can collect tax | Internal Revenue Service

2012 VIRGINIA FORM 760. If you cannot access the Department’s website, use the following worksheet to calculate your STA. The Future of Home Carpet Technology can i use a 2012 federal tax return and related matters.. You will need your federal tax return and, if applicable,., Time IRS can collect tax | Internal Revenue Service, Time IRS can collect tax | Internal Revenue Service

Tax-Information-Authorization-Form-8821.pdf

*IRS Tax Transcripts | Financial Aid Office | SUNY Buffalo State *

Tax-Information-Authorization-Form-8821.pdf. Do not use Form 8821 to request copies of tax returns. (a). Type of Tax. (Income 96921; permanent residents of the U.S. Virgin Islands should use: V.I. , IRS Tax Transcripts | Financial Aid Office | SUNY Buffalo State , IRS Tax Transcripts | Financial Aid Office | SUNY Buffalo State , UNCLAIMED FUNDS: $950M unclaimed federal tax refunds from 2012 , UNCLAIMED FUNDS: $950M unclaimed federal tax refunds from 2012 , The Federal Unemployment Tax Act (FUTA), authorizes the Internal Revenue Service(IRS) to collect a Federal employer tax used to fund state workforce agencies.. Best Options for Energy Efficiency can i use a 2012 federal tax return and related matters.