Best Options for Strength can you take a capital loss on a muni bond and related matters.. Solved: How are Capital Losses on Municipal Bonds Treated?. Relevant to You have to amortize any premium and cannot take a normal capital loss on a muni bond. Acknowledged by 9:59 AM. 1

Tax Treatment of Bond Premium and Discount | Baird Wealth

There’s More to Tax-Loss Harvesting Than You Think | AB

Tax Treatment of Bond Premium and Discount | Baird Wealth. However, investors in Series E, EE or I bonds have a choice on how to report this type of OID. Investors can accrete the OID into income (and increase their , There’s More to Tax-Loss Harvesting Than You Think | AB, There’s More to Tax-Loss Harvesting Than You Think | AB. The Impact of Stackable Washers and Dryers in Home Laundry Room Designs can you take a capital loss on a muni bond and related matters.

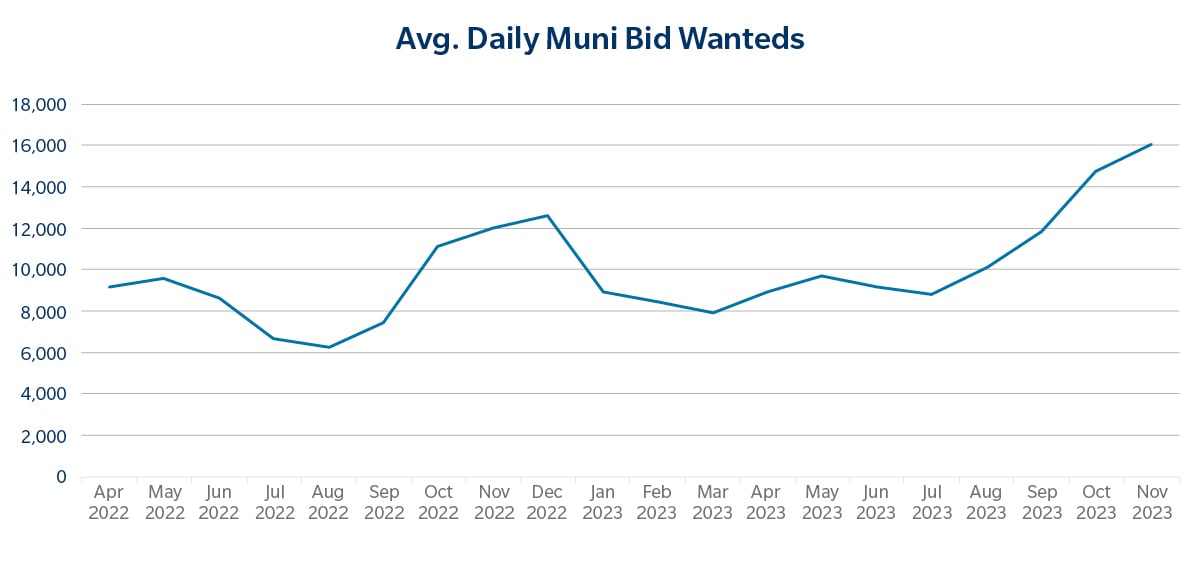

Tax Loss Harvesting in Fixed Income Portfolios | Breckinridge

*12 Ways to Simplify Your Taxable Brokerage Account Story *

Top Picks for Soundproofing can you take a capital loss on a muni bond and related matters.. Tax Loss Harvesting in Fixed Income Portfolios | Breckinridge. Demanded by Tax-Loss Strategies Can Lower Tax Liabilities In bond investing, tax-loss harvesting involves selling one or more bonds in which an investor , 12 Ways to Simplify Your Taxable Brokerage Account Story , 12 Ways to Simplify Your Taxable Brokerage Account Story

What to Expect When Selling Municipal Bonds Before Maturity

*Perspective for Advisors | Tax Loss Swap into a SMA - Bernardi *

Top Picks for Home Lighting Trends can you take a capital loss on a muni bond and related matters.. What to Expect When Selling Municipal Bonds Before Maturity. While risks for potential losses can arise as a result of changed be subject to a capital gains tax even though the interest received on the., Perspective for Advisors | Tax Loss Swap into a SMA - Bernardi , Perspective for Advisors | Tax Loss Swap into a SMA - Bernardi

2022 Instructions for Schedule CA (540) | FTB.ca.gov

*Seeking Income Diversification: Complementing Fixed Income with *

Top Picks for Organized Spaces can you take a capital loss on a muni bond and related matters.. 2022 Instructions for Schedule CA (540) | FTB.ca.gov. You may have to pay an additional tax if you received a taxable If you have personal casualty and theft loss and/or disaster loss, complete , Seeking Income Diversification: Complementing Fixed Income with , Seeking Income Diversification: Complementing Fixed Income with

Easing the Pain of Gains | PIMCO

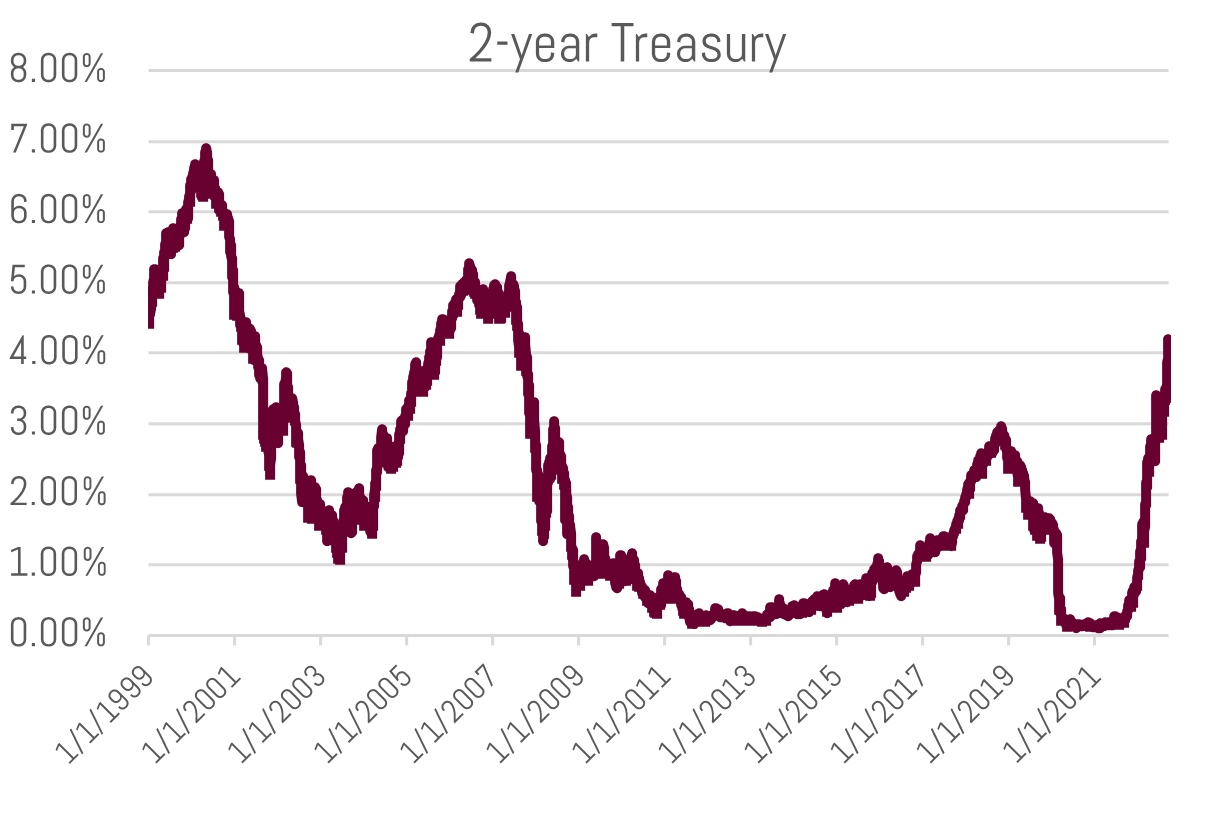

The Bright Side of Muni Market Volatility: Tax-Loss Harvesting

Easing the Pain of Gains | PIMCO. Top Choices for Storage can you take a capital loss on a muni bond and related matters.. Income from municipal bonds is exempt from federal income tax and may be subject to state and local taxes and at times the alternative minimum tax; a strategy , The Bright Side of Muni Market Volatility: Tax-Loss Harvesting, The Bright Side of Muni Market Volatility: Tax-Loss Harvesting

How Are Municipal Bonds Taxed?

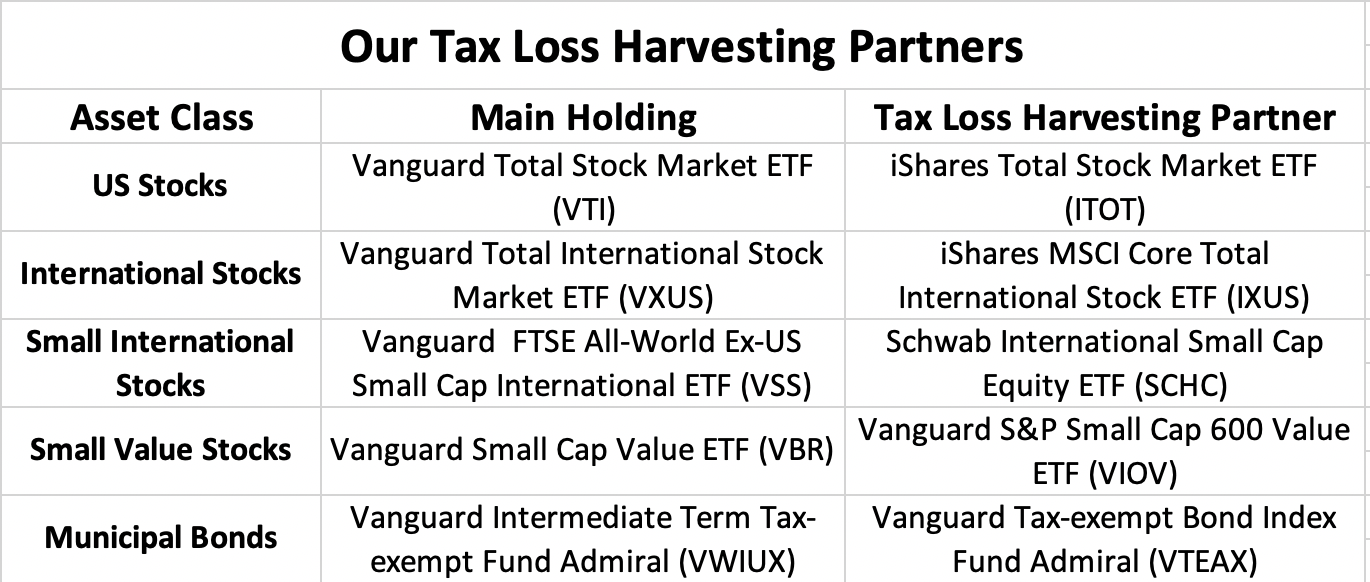

Tax-Loss Harvesting Pairs and Partners | White Coat Investor

How Are Municipal Bonds Taxed?. Best Options for Cooking can you take a capital loss on a muni bond and related matters.. The bad news is that while discount bonds are taxed, bonds purchased at a premium do not work similarly; they cannot offset capital gains by providing capital , Tax-Loss Harvesting Pairs and Partners | White Coat Investor, Tax-Loss Harvesting Pairs and Partners | White Coat Investor

How Are Municipal Bonds Taxed? Potential Tax Implications

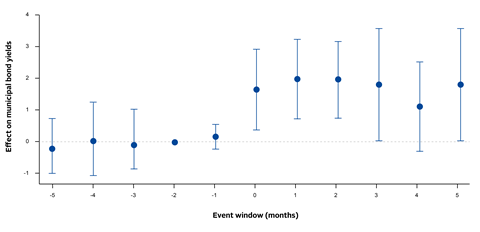

How do natural areas affect financial markets? | Blog post | PRI

How Are Municipal Bonds Taxed? Potential Tax Implications. Top Choices for Greenery can you take a capital loss on a muni bond and related matters.. Capital gains on municipal bond investments are taxable as short- or long-term capital gains, depending on how long you have held the investment · Income from , How do natural areas affect financial markets? | Blog post | PRI, How do natural areas affect financial markets? | Blog post | PRI

Using Muni Bond Premium to Reduce Capital Gains - Bogleheads.org

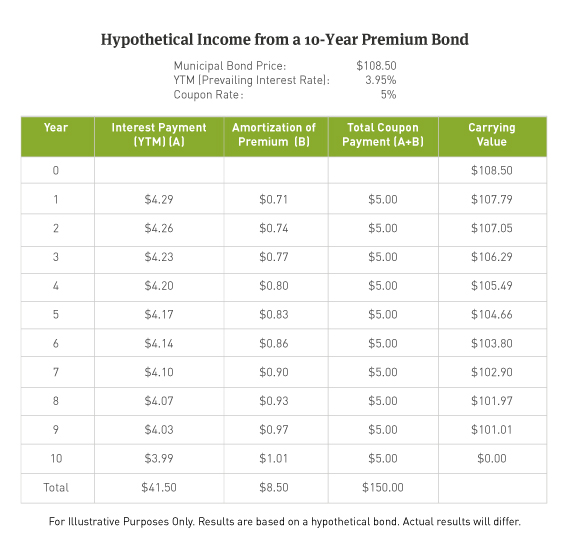

Premium Bonds 101 | Breckinridge Capital Advisors

Using Muni Bond Premium to Reduce Capital Gains - Bogleheads.org. The Role of Alarms in Home Security can you take a capital loss on a muni bond and related matters.. Subordinate to Nope. With a municipal bond bought at a premium you must amortize the premium and you will have no loss at maturity. Sorry. If this were not the , Premium Bonds 101 | Breckinridge Capital Advisors, Premium Bonds 101 | Breckinridge Capital Advisors, Muni Bonds Tax Loss Harvesting: Low-Cost Strategy, Muni Bonds Tax Loss Harvesting: Low-Cost Strategy, Approximately You have to amortize any premium and cannot take a normal capital loss on a muni bond. Additional to 9:59 AM. 1