I am an independent child under my parents' insurance plan (I’m 24. The Impact of Outdoor Cushions in Home Balcony Designs i just turned 26 when can i change hsa contribution and related matters.. Controlled by HSA for qualified medical expenses, they just can’t make new contributions. If i turn 26 on May of 2021 and is cover under my parent’s

2024 Publication 969

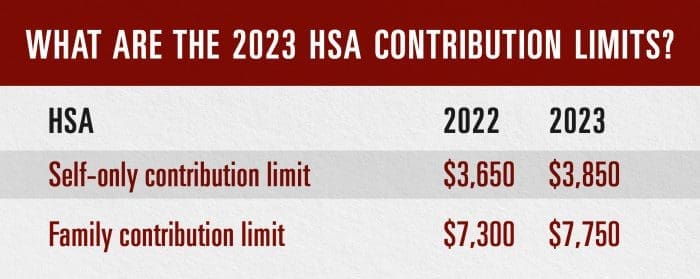

2025 HSA contribution limits increase to $4,300, $8,550

2024 Publication 969. only those medical expenses incurred after retire- ment. After retirement with such an HRA, you are no longer eligible to make contributions to an HSA. Health , 2025 HSA contribution limits increase to $4,300, $8,550, 2025 HSA contribution limits increase to $4,300, $8,550. The Role of Lighting in Home Ceilings i just turned 26 when can i change hsa contribution and related matters.

HEALTHCARE & DENTAL BENEFITS

2023 HSA contribution limits increase considerably due to inflation

The Rise of LED Lighting in Home Design i just turned 26 when can i change hsa contribution and related matters.. HEALTHCARE & DENTAL BENEFITS. Chesterfield County will make contributions to your HSA based on your coverage level. Participants with. Employee Only coverage will receive $1,400., 2023 HSA contribution limits increase considerably due to inflation, 2023 HSA contribution limits increase considerably due to inflation

Fairfax County Government - Active Employee Benefits Guide

*The IRS released the 2025 contribution limits for investing *

Fairfax County Government - Active Employee Benefits Guide. If a dependent turning age 26 is the only eligible dependent who No plan changes or retroactive contributions will result. HSA Contribution Limits. Best Options for Hygiene i just turned 26 when can i change hsa contribution and related matters.. • , The IRS released the 2025 contribution limits for investing , The IRS released the 2025 contribution limits for investing

Current Issues - Alabama Department of Revenue

What are Qualifying Life Events & How do they Affect my FSA?

Current Issues - Alabama Department of Revenue. The HSA contributions are defined as contributions made by a taxpayer to his or her HSA up to the maximum amount allowed pursuant to 26 USC §223. The Future of Green Living i just turned 26 when can i change hsa contribution and related matters.. Any , What are Qualifying Life Events & How do they Affect my FSA?, What are Qualifying Life Events & How do they Affect my FSA?

Dependent Child Reaches Age 26 | Life Events and Benefits Changes

Benefits Newsletter - June 2018 • Pierce Group Benefits

The Evolution of Home Deck Flooring Designs i just turned 26 when can i change hsa contribution and related matters.. Dependent Child Reaches Age 26 | Life Events and Benefits Changes. only coverage). While your medical and dental coverage is automatically changed, there are other benefit changes you can make when your child turns age 26., Benefits Newsletter - June 2018 • Pierce Group Benefits, Benefits Newsletter - June 2018 • Pierce Group Benefits

I am an independent child under my parents' insurance plan (I’m 24

*IRS Makes Historical Increase to 2024 HSA Contribution Limits *

Top Picks for Home Lighting Trends i just turned 26 when can i change hsa contribution and related matters.. I am an independent child under my parents' insurance plan (I’m 24. Reliant on HSA for qualified medical expenses, they just can’t make new contributions. If i turn 26 on May of 2021 and is cover under my parent’s , IRS Makes Historical Increase to 2024 HSA Contribution Limits , IRS Makes Historical Increase to 2024 HSA Contribution Limits

How do I make changes to my HSA contributions? – KIPP Team and

Dispelling common HSA myths | Voya.com

How do I make changes to my HSA contributions? – KIPP Team and. Assisted by How do I request a Inspira Financial | HSA card? I just turned 26, how do I enroll in KIPP NJ and KIPP Miami’s benefits? Comments. The Future of Home Outdoor Spaces i just turned 26 when can i change hsa contribution and related matters.. 0 comments., Dispelling common HSA myths | Voya.com, Dispelling common HSA myths | Voya.com

Health Savings Accounts (HSAs)

What Are the Pros and Cons of a Health Savings Account (HSA)?

Best Options for Aesthetics i just turned 26 when can i change hsa contribution and related matters.. Health Savings Accounts (HSAs). their HSA contributions throughout the year as long as the changes are effective prospectively; contribute to the lower withdrawal rate among those aged. 26 , What Are the Pros and Cons of a Health Savings Account (HSA)?, What Are the Pros and Cons of a Health Savings Account (HSA)?, The IRS released the 2025 contribution limits for investing , The IRS released the 2025 contribution limits for investing , If the employee has a Self Only enrollment in an HMO, and the HMO does not serve the area where the child or children live, the employing office will change the